Crypto Currency has gone main stream

Cryptocurrency, a subset of an entire category of digital currencies, sounds like something that will matter to us in the future - somewhere way out there.

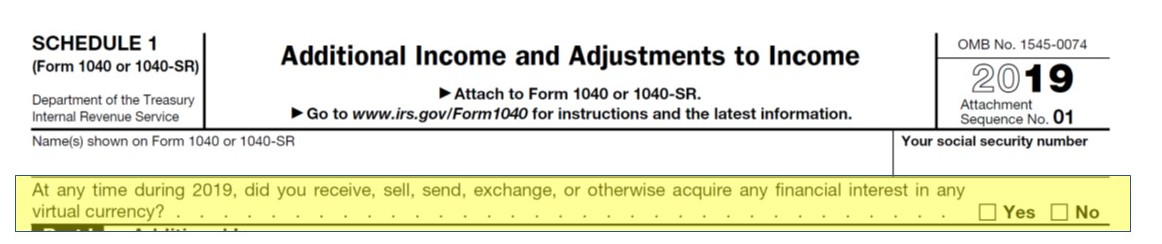

But when it comes to "crypto-", "digital", or "virtual" currency, the future is here -- as evidenced by the latest modification to the Federal individual income tax return for 2019, Form 1040, schedule 1. When the IRS is asking about it, the concept has become mainstream.

The IRS defines virtual currency as "a digital representation of value that functions as a medium of exchange, a unit of account, and a store of value other than a representation of the United States dollar or a foreign currency. Cryptocurrency is a type of virtual currency that utilizes cryptography to secure transactions that are digitally recorded on a distributed ledger, such as a blockchain. Units of cryptocurrency are generally referred to as coins or tokens."

Starting with returns filed this year, taxpayers are required to answer this question about "virtual" or digital currency:

Cryptocurrency (Bitcoin, Zcash, and Tether are the most popular) is basically treated as a capital asset for income tax reporting purposes and requires the tracking of cost basis versus sales proceeds in order to calculate and report the correct amount of gain or loss. Taxable gain is reported on IRS Form 8949 and Schedule D.

Please contact your tax advisor if you have specific questions related to investments in virtual currency.

Impact on Wineries

Although we have not seen digital currencies in wide use in the wine industry, this is a harbinger of disruptions ahead. We can expect changes in the technology that we are using in our tasting rooms and e-commerce sites as payment methods change.

Vendors like Veem.com, which specializes in global electronic payments, is already leveraging blockchain to simplify the flow of funds. In addition, blockchain technology (but not digital currency) is being used to verify the integrity of wine labels.